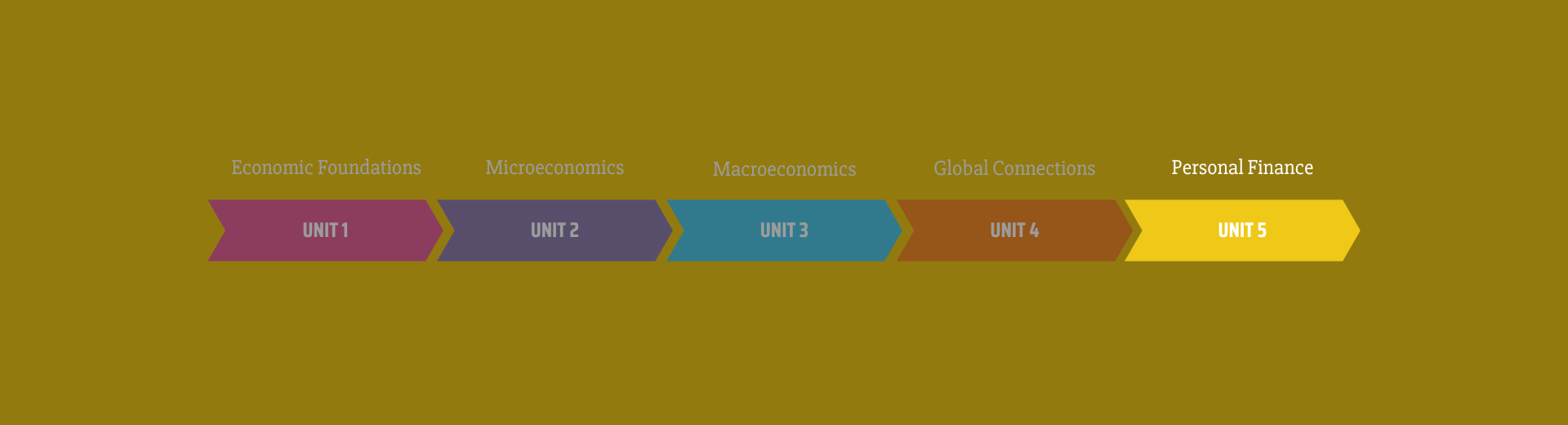

About Unit 5

New to our curriculum? Start here.

Check for upcoming or on-demand curriculum workshops.

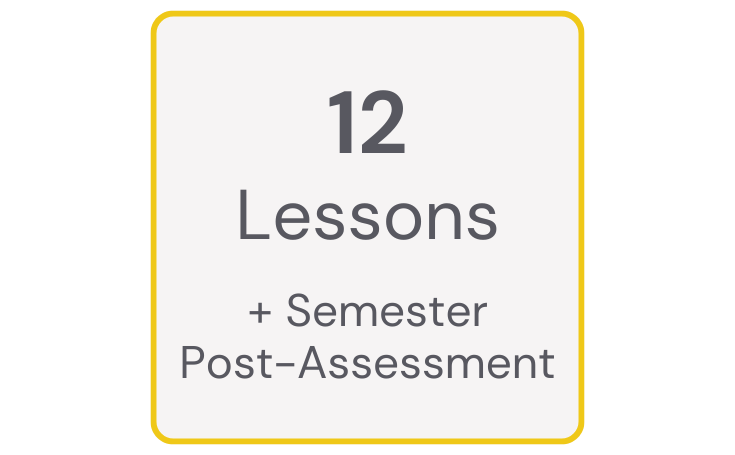

Lessons build on one another and are designed to be used sequentially. If you plan to use one of the lessons in isolation, review the Overview documents (Unit 1, Unit 2, Unit 3, Unit 4, Unit 5). To unlock all lessons you must log in as an Econiful member.

5.1 The Promise and Peril of Compound Interest

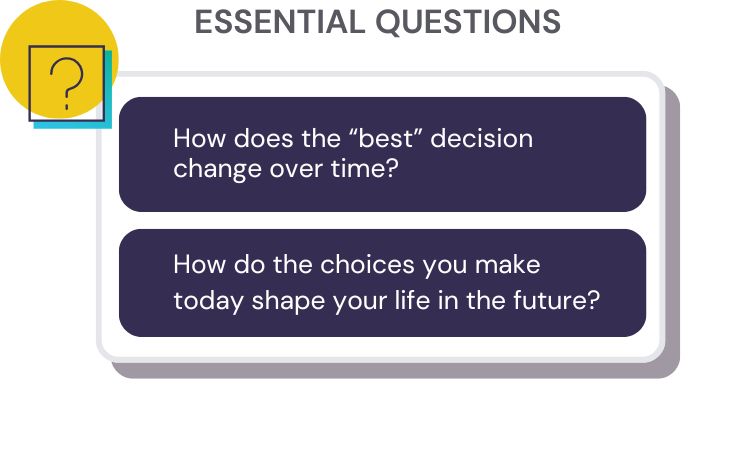

Through real-world examples, data tools, and financial scenarios, students examine how compound interest can work both for and against individuals, and gain a foundational concept they will revisit throughout the personal finance unit.

5.2 Investing Like an Economist

Students explore foundational investing advice grounded in economic research through a choose-your-own-adventure-style activity.

5.3 Thinking About Credit Like an Economist

Students explore the costs and benefits of using credit (specifically credit cards and student loans) through video clips, readings, and discussions of real-world credit scenarios.

5.4 Why Credit Scores Matter for Your Future

By moving through a board game that mirrors real-world credit decisions, students discover how their actions can affect their credit score. In the latter half of the lesson students take a quiz to reinforce the personal finance concepts introduced thus far.

5.6 Decoding Paycheck Deductions

Students analyze earnings statements to explain why workers with the same salary can have different amounts of take-home pay. Through guided investigation, students learn how taxes, benefits, and individual choices affect net pay and consider how planning influences financial decisions over time.

5.13 Semester Post-Assessment

A no-stakes test of economic literacy is repeated at the end of the semester to determine growth.